자료실[보고서]

HOME > 커뮤니티 > 자료실[보고서]

날짜 21.09.08 조회 827

주택연금의 소득대체율에 관한 연구

A Study on Replacement Rates of Reverse Mortgage Loan

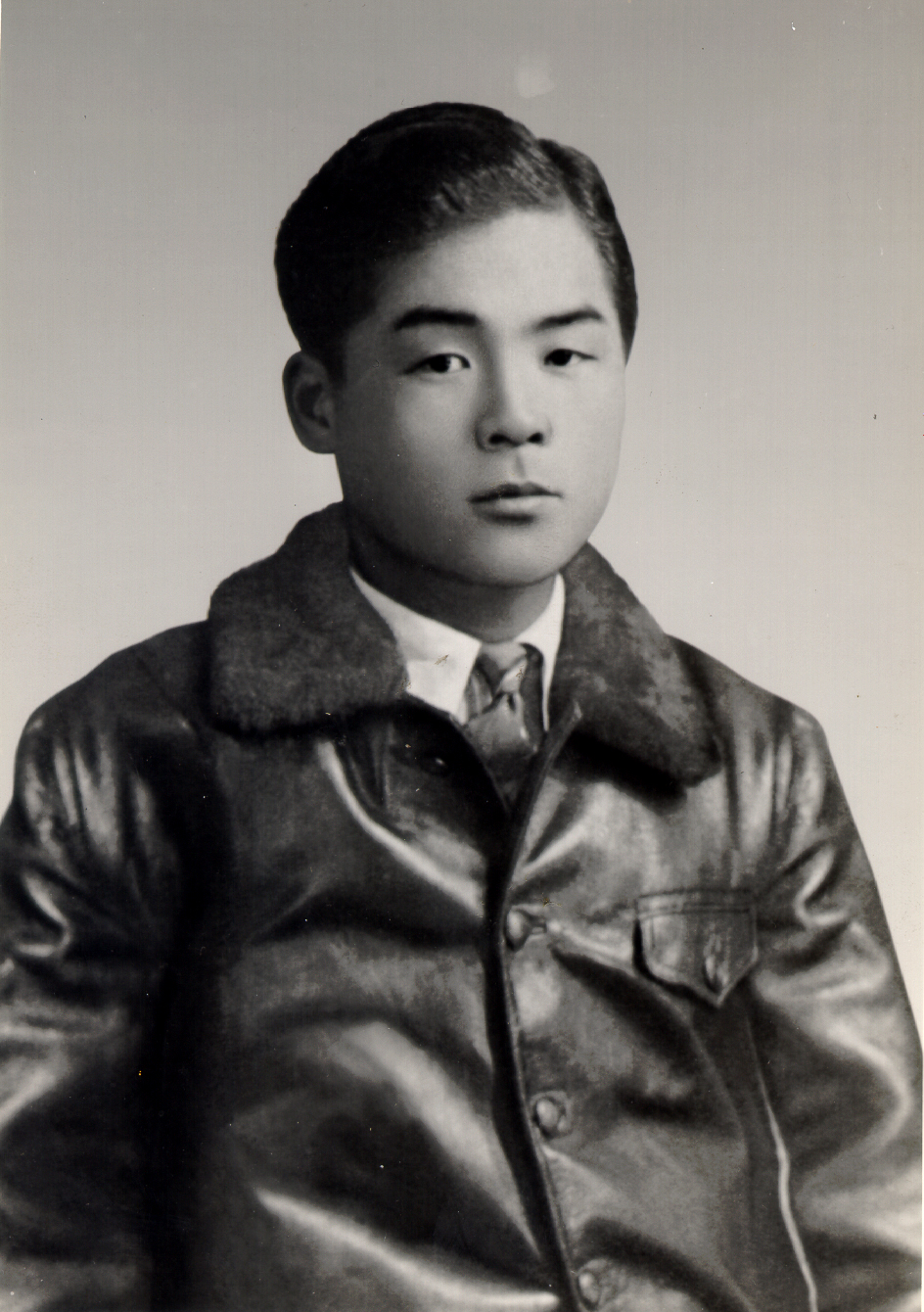

여윤경 이화여자대학교 경영학과 교수, 개인재무학 박사, yuhyk@ewha.ac.kr

目 次

Ⅰ. 서론

Ⅱ. 선행연구 고찰

1. 소득대체율 산정모형

2. 소득대체율 관련 실증연구

Ⅲ. 연구방법

1. 연구자료

2. 주택연금의 소득대체율 추정

Ⅳ. 연구결과 및 논의

1. 주택연금 소득대체율 관련요인의 추출

2. 주택연금 소득대체율 결정요인 및 시뮬

레이션 분석

Ⅴ. 결론 및 시사점

<abstract>

<참고문헌>

ABSTRACT

1. CONTENTS

(1) RESEARCH OBJECTIVES

This study estimated reverse mortgage(JTYK) replacement rates of retired

households and analyzed major determinants of the rates. Results of this study provide

useful implications for future reverse mortgage system and public/private pension

policy in Korea.

(2) RESEARCH METHOD

For the purpose of this study, empirical replacement rates model based on life cycle

hypothesis were used. Using 2015 survey on demand of reverse mortgage loan(JTYK)

by Korea Housing Finance Corporation, classified reverse mortgage replacement rates

by specific retired households groups were forecasted. To investigate major factors

affecting the replacement rates, ANOVA, regression analysis, and simulation were

utilized.

게제지 : 부동산학보 제72집 pp. 74-86

출처 : http://www.reacademy.org 한국부동산학회

※ 본 연구는 (사)대산신용호기념사업회의 연구지원을 받아 수했되었음.

|

트위터 | 페이스북 | 카카오톡 | 카카오스토리 | 라인 |

|

|